VAT Health Check: UAE Tax

VAT Health Check: VAT is a complex tax affecting every aspect of your business in the UAE and the worldwide market. As a self-assessing tax, it is the responsibility of the taxpayer to ensure they are accounting for the right amount of tax and at the right time. FTA carry out VAT inspections or audits at varying intervals. If they identify errors, the company shall be subjected to penal provisions including levy of tax, interest, and fines.

The main purpose of a VAT Health Check is to ensure that as a business your handling of VAT is in line with current FTA VAT laws and regulations.

VAT Health Check includes the following:

- Assess your in-house accounting records; documentation; VAT records etc.

- Review of your filed returns to identify any grey areas wherein you are perpetually making errors.

- Check if the returned figures as per VAT documents match with the financial records

- Analyze if you are making use of the VAT laws in getting proper credits or refunds for your business and if the same are claimed in the returns

- Identify areas wherein you can plan for a proper VAT planning

- Review of maintenance of accounts and records and audit trail for your VAT files.

- Identifying areas of concern or opportunities

- Confirm that all your VAT returns are filed correctly and properly in relation to your business income and allowable expenses

- Confirm that all your registration documents are incompatible with the FTA requirements and if all of them are replaced or renewed whenever it is due.

- VAT Health Check helps to determine the best scheme suited for your type of business for VAT accounting.

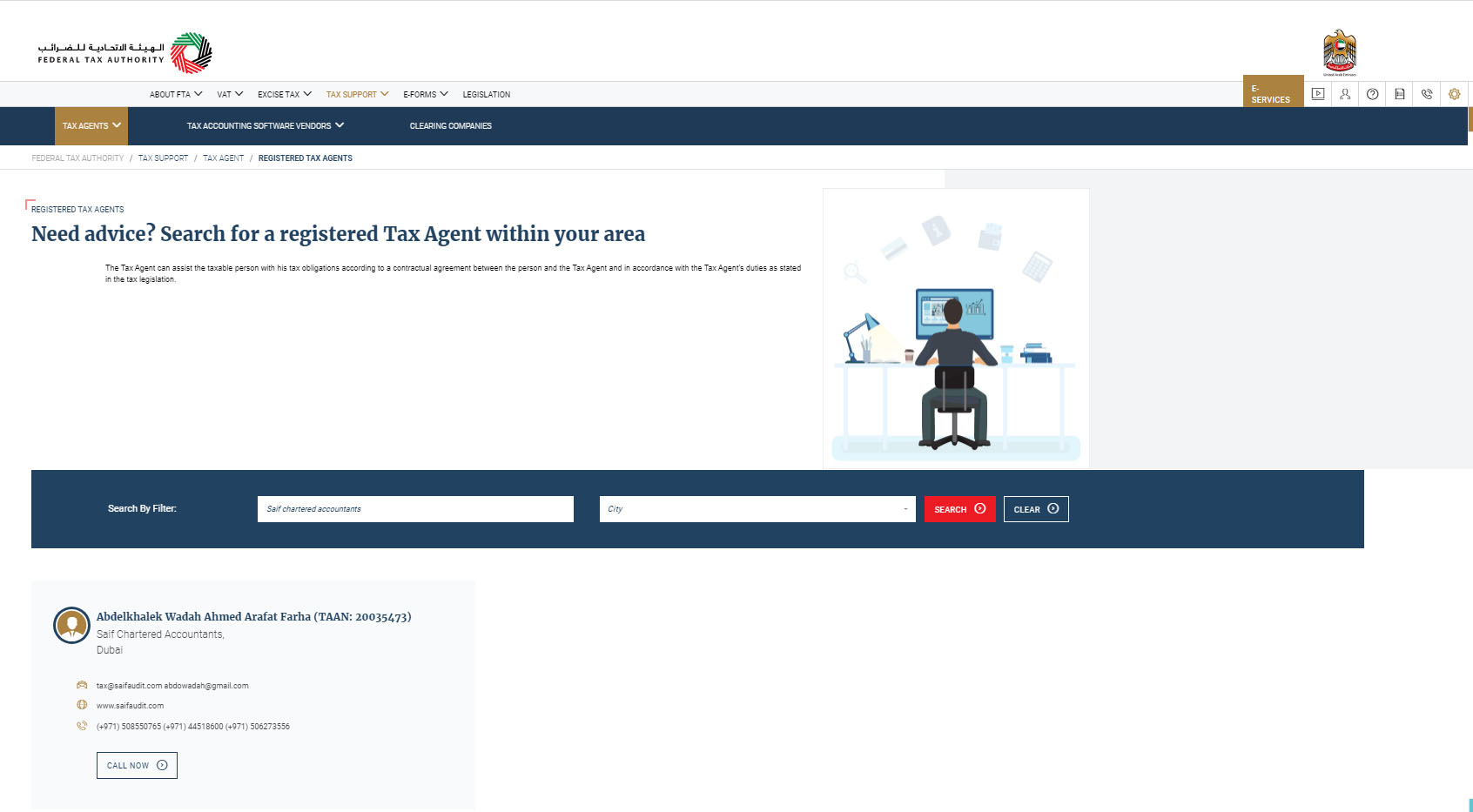

Related: Chartered Accountants Dubai : SGA World UAE, VAT UAE – Value Added Tax, #1 Audit firm in Dubai – Saif Chartered Accountants, VAT refund scheme: 4 conditions for UAE retailers, #1 Audit firm in Dubai – Saif Chartered Accountants, #1 Audit firm in Dubai – Saif Chartered Accountants

Recent Comments