Category: VAT in Dubai

Bad Debt Relief Adjustment : VAT registered supplier supplies goods or services to its customers but is not paid (wholly or partially) within a specified period, such supplier may …

Automotive sector VAT : The Federal Tax Authority has published an update applicable to business in the automotive sector such as New car dealers, Used car dealers and Servicing …

Commercial Activities Certificate UAE - A certificate issued by the FTA to enable applicants to refund VAT paid outside the UAE, whether or not DTAAs are applicable.

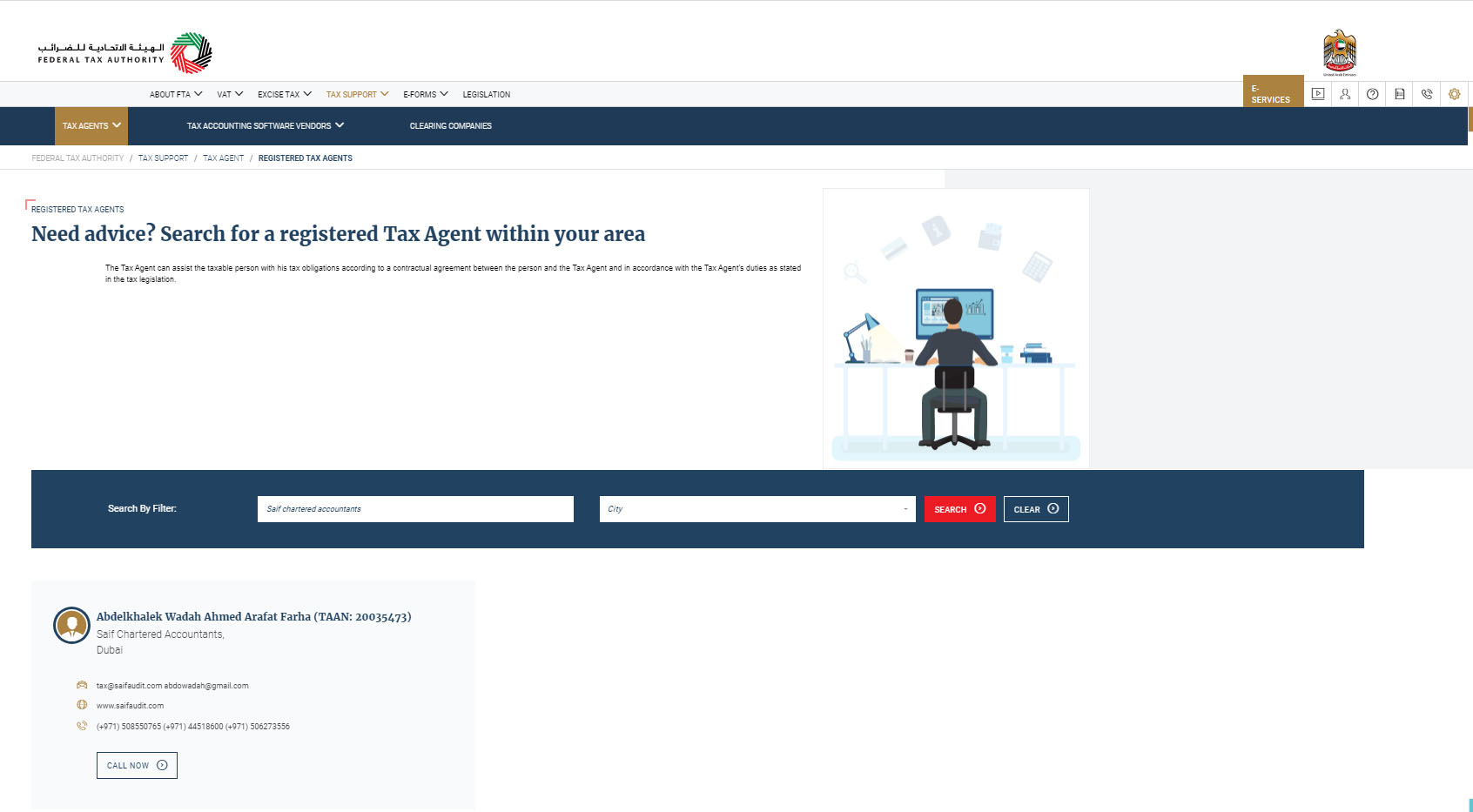

Saif Chartered is one of the Registered Tax Agents in Dubai, UAE. Saif Audit is authorized by the Federal Tax Authority (FTA) to be appointed as Tax Agent by …

Appeal procedures for FTA - Any person may submit a request to the Authority to reconsider any of its decisions issued within 20 business days.

Know the procedure and how to be prepared for Tax Audit in UAE Tax Audit in UAE: The UAE government has already implemented VAT on the supply of taxable …

VAT Health Check: UAE Tax VAT Health Check: VAT is a complex tax affecting every aspect of your business in the UAE and the worldwide market. As a self-assessing …

Tax Invoices: FTA Decision No. (4) of 2018 on Tax Invoices 1. Where a Registrant makes a supply of Goods or Services through vending machines, there shall be no …

VAT 301 Notification VAT 301 Notification from FTA : VAT301 Notification Arabic منذ تطبيق ضريبة القيمة المضافة في 01/01/2018 ، أصبح نموذج VAT301 متاحًا على بوابة الخدمات الإلكترونية الخاصة …

VAT UAE VAT UAE : The UAE has issued Federal Decree Law No. (8) of 2017 on Value Added Tax (VAT) (“VATLaw”) which is now implemented in the UAE …

Recent Comments