Tax Agency Number (TAN) 30004113

UAE Corporate Tax Registration

UAE Corporate Tax Registration

UAE Corporate Tax Registration : Business may be required to register for CT even if it is already registered for VAT

UAE Corporate Tax Registration : The business community in the UAE will be subject to corporate taxes beginning June 1, 2023. In order to prepare for these new regulations, it is important to understand the administrative requirements such as tax registration, deregistration, filing of corporate tax returns, and payment. Consulting with a corporate tax consultant in Dubai helps business owners have a prior understanding of compliance related requirements and avoid hefty penalties in the UAE.

UAE Corporate Tax Registration : How and When to Register ?

Corporations in UAE have to register with the Federal Tax Authority and get a corporation tax registration ID or number.

The UAE Corporate tax registration applies to all businesses whether they are subject to 0 percent or 9 percent corporation tax. Depending on your business needs, you can choose from a list of corporate tax advisors in UAE who help you with all types of tax registration.

Where to Register : www.eservices.tax.gov.ae

Download Corporate Tax Registration User Manual

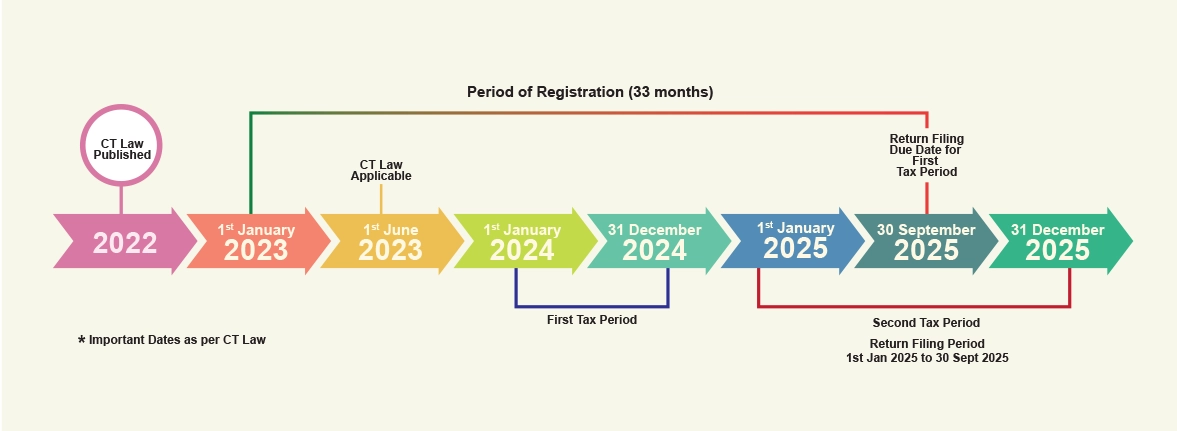

Corporate Tax Registration Timeline in the UAE

According to information provided on the FTA website, taxable persons have until the date of their first tax filing to register. For example, if a taxable person has a year ending on May 31st, they have a registration period of 26 months available until February 28th, 2025. Similarly, for taxable persons with a financial year ending on December 31st, a registration period of 33 months is available until September 30th, 2025.

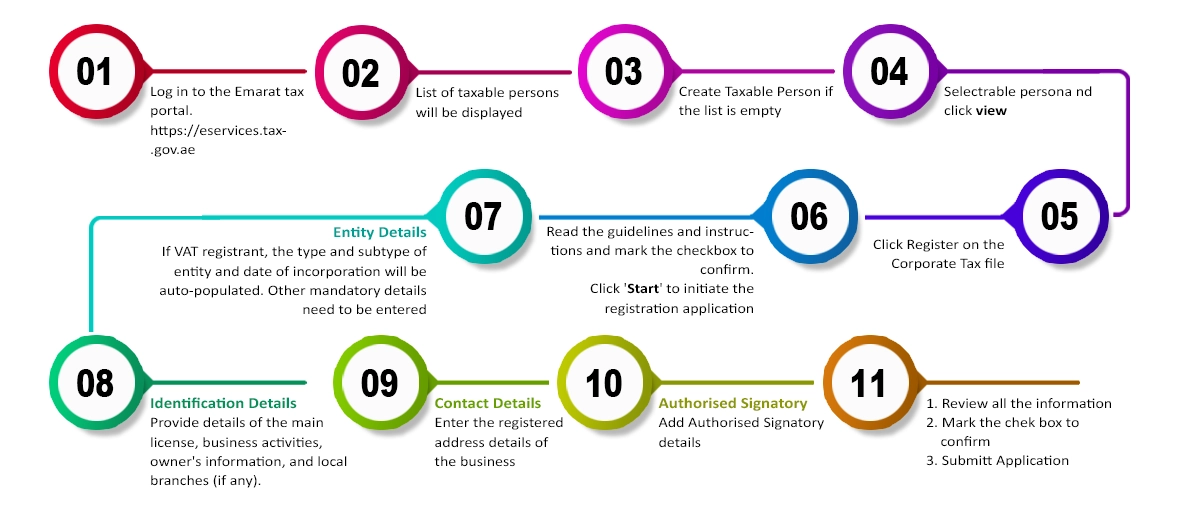

The FTA has published a user manual with guidelines and instructions for using the EmaraTax portal. Below is an overview of the corporate tax registration process in the UAE:

UAE Corporate Tax De registration

If your business is a corporation and is registered for corporate tax, you must deregister it before it ceases to be subject to corporate tax. The FTA will deregister your business if you have filed corporate tax returns, settled all of its corporate tax liabilities, and settled any penalties due for periods up to and including the date of cessation.

UAE Corporate Tax Return Filing

The FTA requires that businesses be allowed to file a single consolidated tax return, rather than requiring them to file multiple returns. This consolidated return must be filed within nine months of the end of each relevant tax period.

To find out more about e-filing corporate tax returns in the UAE, Please contact us : Saif Chartered Accountants, Dubai, UAE.

UAE Corporate Tax deadlines

The corporate tax regime is based on a self-assessment principle which means businesses are responsible for ensuring that the documents they submit to the FTA are correct and comply with the law.

The new UAE corporate tax regime allows taxpayers up to 21 months from the start of their financial year to prepare for filing and making their tax payments.

For example, businesses with a financial year starting on June 1, 2023, and ending on May 31, 2024, have until February 28, 2025 to file their corporate tax returns and make their payments.

For a business whose first tax period begins on January 1, 2024 and ends on December 31, 2024, the return and payment must be filed between January 1 and September 30, 2025.

Exemptions from UAE Corporate Tax

UAE Corporate Tax Rate

Corporate Tax rate for free zones

Free Zone (including financial free zones) businesses in UAE will be subject to Corporate Tax. However, it has been clarified that the Corporate Tax regime will continue to honour the corporate tax incentives currently being offered to free zone businesses that comply with all regulatory requirements and that do not conduct business in mainland UAE. Businesses established in a free zone will be required to register and file a Corporate Tax Return.

Other services

@2022 Saif Chartered Accountants, Dubai, UAE. All rights reserved. | Sharjah Abudhabi DMCC Global